Home |

We’re thrilled to share that as of January 1, 2024, Wagner, Duys & Wood, LLLP, and Kaplan Company, P.C., have merged to create Wagner, Kaplan, Duys & Wood LLP. This merger combines our expertise and resources, enhancing our ability to serve our clients in the tax and financial sectors. Our new team includes six partners…

Read ArticleIf a foreign investor acquires at least a 10% voting control of a United States commercial real estate property, in addition to income tax filings, they will be required to file information forms with the United States Department of Commerce, Bureau of Economic Analysis (“BEA”). These reports filed by the foreign investors are not made…

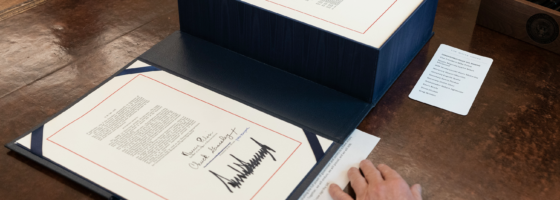

Read ArticlePRESIDENT TRUMP SIGNS INTO LAW CARES ACT On March 27, 2020, President Trump signed into law the Coronavirus Aid, Relief and Economic Security (CARES) Act, which provides relief to taxpayers affected by the novel coronavirus (COVID-19). The CARES Act is the third round of federal government aid related to COVID-19. Summarized of the top provisions…

Read ArticleInterest Deduction Limit under TCJA Under the Tax Cuts and Jobs Act of 2017 (TCJA), the deduction for interest paid or accrued to a related or unrelated party is limited to the sum of the taxpayer’s business interest income and 30% of adjusted taxable income for the year. For taxable years before 2022, the limitation…

Read ArticleForeign investors are often motivated to acquire U.S. real property when considering the opportunity for appreciation in value and a profitable return on investment. There are different investment structuring alternatives that may attract foreign investors to the U.S. real estate market. A common typical structure that has certain advantages is the U.S. blocker corporation. The…

Read ArticleAre you ready to gain control over your Business interests?

Contact us today to see how Wagner Duys & Wood can help you succeed.