Key Answers to the Top Ten Questions on the New Limits Governing Interest Deductions for FIRPTA Blocker Corporations

Interest Deduction Limit under TCJA

Under the Tax Cuts and Jobs Act of 2017 (TCJA), the deduction for interest paid or accrued to a related or unrelated party is limited to the sum of the taxpayer’s business interest income and 30% of adjusted taxable income for the year. For taxable years before 2022, the limitation is based on adjusted taxable income (“ATI”), which is taxable income before interest, Federal income taxes, depreciation and amortization (EBITDA). For taxable years after 2021, the limitation will be on taxable income before interest and Federal taxes (after depreciation and amortization) (EBIT).

There are two main exceptions to the rule. The first is for “small” taxpayers whose gross receipts are below a threshold level. The second is for a Real Property Trade or Business (RPTB).

A small taxpayer is a taxpayer which had average annual gross receipts of $25 million or less for the 3 preceding tax years. For the $25 million threshold, a C corporation would include its share of an LLC’s revenue if the companies are commonly controlled. Without common control, the C corporation would take into account its share of the Schedule K-1 net income or loss from the LLC. However, one must be careful as this exception is not always available. This exception does not apply when 35% or more of the losses from a partnership or an LLC are allocated to limited partners or limited entrepreneurs (members of an LLC that do not manage the LLC). As a result, FIRPTA blocker corporations may not qualify for this exception if 35% or more of the losses are allocated to the blocker as a non-managing member of the LLC.

FIRPTA blocker corporations and LLCs in which they are invested typically may qualify for the RPTB exception. An LLC must make an irrevocable election to be treated as a RPTB. Any trade or business which is engaged in property development, construction, acquisition, rental operations, hotel operation, management, and leasing is eligible to make the election. However, there is a downside to making the election. A RPTB must use the slower alternative depreciation system (“ADS”) rather than the general depreciation system (“GDS”) to depreciate any of its nonresidential real property, residential property, and qualified improvement property. ADS depreciable life is 30-year straight line for residential real estate instead of 27.5 years under GDS and 40-year straight line for nonresidential real estate instead of 39 years under GDS. Qualified improvement property (“QIP”) has a 20-year life for ADS instead of the 15-year GDS life. QIP is any improvement to the interior of nonresidential real property that is placed in service after the building. QIP does not include an improvement attributable to the enlargement of the building, an elevator or an escalator, or the internal structural framework of the building. Due to a drafting error in the legislation, QIP has a 39-year useful life. A technical correction is expected to change the useful life of QIP to 15 years and QIP could qualify for bonus depreciation under GDS but not under ADS.

There is a new rule that limits net operating losses (NOLs) for corporations. For tax years beginning in 2018, the amount of net operating loss that is allowed to be deducted in any year is limited to 80% of the current year’s taxable income. Depending on the operating activity and the amount of leverage, a blocker corporation may have net operating income or net operating losses for U.S. tax purposes. If a blocker corporation has NOLs, a slowdown of depreciation may be desired. The slowdown in depreciation will decrease the amount of NOLs that are subject to the limitation and defer the depreciation into future years where the NOL limitation is not as likely to be an issue.

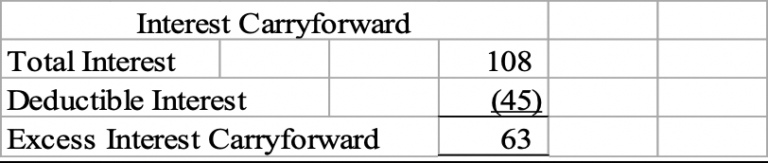

The business interest limitation applies to LLCs at the LLC level. Any business interest that isn’t deductible by an LLC for any tax year because of the business interest limitation is treated as excess business interest that’s allocated and flows through to each LLC member. It is not deferred to the next year at the LLC level.

The member may deduct its share of the LLC’s excess business interest in any future year, but only against excess taxable income attributed to the member by the LLC whose activities gave rise to the excess business interest carryforward. If the blocker corporation invests in multiple deals, the excess interest must be tracked separately for each activity.

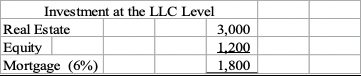

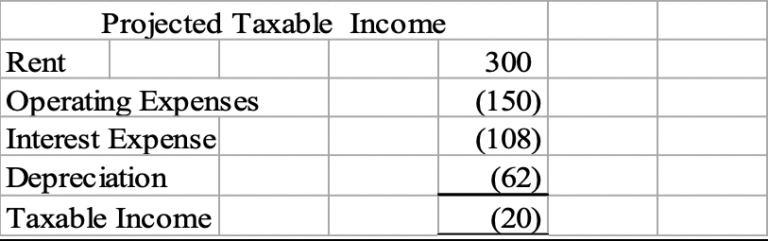

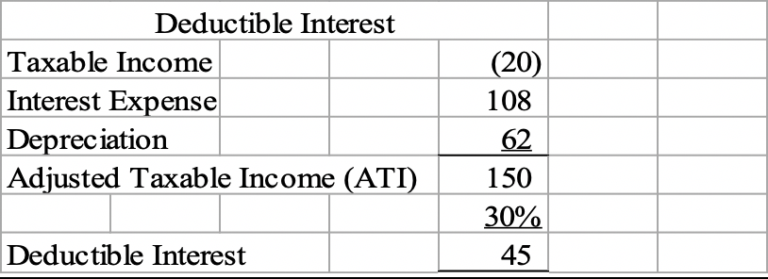

The following example is a real estate investment held by an LLC. The example assumes the LLC is not an electing real property trade or business.

In addition, assume at the blocker level, the blocker has its own level of debt. The interest incurred at the corporate level would also be disallowed in the current year and would be added to the excess interest carryforward.

If the LLC and the blocker are both considered electing real property trades or businesses, then all of the LLC and blocker level interest is fully deductible.

The following are important tax issues in the typical FIRPTA blocker structure that were not specifically addressed in the I.R.C. section 163(j) regulations that the IRS issued in November 2018.

1. Can a blocker corporation elect to be an electing real property trade or business or receive this treatment if the LLC it invested in is an electing real property trade or business?

It appears that if the LLC is an electing real property trade or business then all upper tier pass through entities and the blocker corporations are also considered electing real property trade or businesses. The blocker and the LLC are treated as one single investment in real property, via the look-through status of the LLC. The blocker treats its ownership in the LLC as an electing real property trade or business. All of the interest expense should be allocated to the real property trade or business. As noted below in more detail, this also may include interest expense on the blocker debt incurred from its parent or an unrelated third party that supports the real property trade or business.

The IRS did not provide guidance to clarify if the election is only made at the LLC level, or if all upper tier entities including the blocker corporations would also need to make the election. It would be a best practice to make a protective election on the tax return for every entity in the structure.

2. If the LLC makes the election to be an electing real property trade or business, is the blocker corporation bound by the election or can it elect out?

It appears that if the LLC is an electing real property trade or business, the election is binding on the blocker corporation. However, there may be some important economic reasons why the blocker corporation might prefer not to be an electing real property trade or business. For example, one possible reason is that it may be more advantageous to defer the interest deduction in order to mitigate the effect of the limitation on the use of NOLs to 80% of taxable income in the final year of disposition.

3. What if the LLC does not elect the RPTB but the blocker corporation would prefer to make the election?

The LLC and the blocker corporation are one single real estate investment vehicle effectuated with a look-through structure. If the LLC does not make the election, the blocker cannot.

4. If the LLC makes the RPTB election, does the RPTB exception apply to the interest expense that the blocker corporation pays to the foreign parent?

The I.R.C. section 163(j) regulations provide a possible option for the blocker to take either position. The blocker can rely on the LLC’s RPTB election. Alternatively, the blocker could take the position that the interest is not deductible and suspend the interest above the 30% ATI limitation and carry it forward to use in the year of disposition. This may be beneficial if there is enough interest at the LLC level flowing up to the blocker so that the blocker does not have taxable income in a rental operation year. The interest expense from the debt at the blocker level could then be used in the year of disposition to mitigate the effect of the 80% NOL limitation.

5. If an LLC owned real estate before 2018 and decides to become an electing real property trade or business in 2018, does the LLC need to elect a change in accounting method to ADS for assets acquired before 2018?

In late December, the IRS issued Revenue Procedure 2019-8 which states that it’s not a change in accounting method, but a change in use of the asset. The LLC will depreciate the remaining tax basis of the depreciable real estate over the remaining ADS life. Residential property acquired before 2018 will be depreciated over the 40-year ADS life that was the law before TCJA, not the 30-year law enacted in the TCJA. This deceleration of depreciation could work in the favor of a blocker, especially those that are leveraged and have NOLs. This is because NOLs may be limited in the year of property disposition due to the new limitation. Limiting the amount of the NOLs and depreciation to recapture upon disposition, could reduce, if not completely offset, the effects of the new NOL limitation.

6. Could the blocker corporation benefit from the more advantageous rules for cost segregation?

While the regulations specifically state that an electing RPTB must use ADS to depreciate real property, personal property may still be eligible for MACRS and bonus depreciation. A cost segregation study can be used to break out the purchase price between personal property and real property. For blocker corporations that are projecting corporate level taxable income on operating income, a cost segregation study may provide a benefit

7. What is the tax treatment of excess interest when the property is sold by the LLC or the blocker corporation sells its LLC interest?

In most moderate to highly leveraged real estate deals there will be excess interest if the electing real property trade or business election is not made. Any excess interest remaining at the end of a deal is added to the member’s basis in the LLC immediately before the disposition. A sale of the LLC interest could result in a capital loss due to the higher basis. The capital loss would be available to offset the gain from the LLC’s sale of the property but only if the LLC interest is disposed of within 3 years after the year of the property sale. Capital losses can be carried back 3 years and forward 5 years, unlike NOLs with indefinite carryforward but no carryback. The NOL and capital loss carryforwards would continue to be available for future use if the blocker subsequently invests in a new deal. However, the NOL and capital loss carryforwards could be limited if there is more than a 50% ownership change of the blocker.

8. If the LLC and the blocker are not electing real property trades or businesses, does the blocker combine its own ATI and interest expense with its share of such items from the LLC?

The LLC determines its ATI, the 30% ATI limitation, and deductible interest expense at the partnership level. Any business interest expense (“BIE”) that exceeds the LLC’s 30% ATI limitation for the year becomes excess business interest expense (“EBIE”) at the blocker level. The blocker’s share of the EBIE becomes deductible when the LLC allocates excess taxable income (“ETI”) or excess business interest income (“EBII”) to the blocker in a subsequent year.

The blocker does not combine its own ATI with the ATI of the LLC. The blocker calculates its own ATI by combining its own income and its distributive share of any excess taxable income from the LLC. The blocker does not combine its own business interest expense with the business interest expense of the LLC. The blocker takes into account its share of the excess business interest expense from the LLC in determining the amount of deductible business interest expense at the blocker level.

The following is a basic example of how to calculate the ATI, 30% ATI limitation, and deductible business interest expense for a blocker invested in an LLC. Assume the blocker is a 50% member of the LLC. The LLC has ATI of $200, $0 business interest income (“BII”), $30 of business interest expense for the current year, and $10 of excess business interest expense from the prior year. As the LLC member, the blocker has its own ATI of $100 and $20 of business interest expense. The LLC allocates $100 of ATI, $15 of BIE, and $5 of EBIE to the blocker. The LLC’s 30% of ATI limitation is $60 ($200 ATI x 30%). The blocker’s $15 share of BIE from the LLC is fully deductible. The excess taxable income from the LLC is $100 with $50 of ETI allocated to the blocker. The ETI is calculated as follows.

{ATI $200 x [(ATI $200 x 30%) – (BIE $30 – BII $0)]} =

(ATI $200 x 30%)

$200 x ($60-$30)/$60 = $200 x $30/$60 = $100

The blocker increases its own ATI of $100 by the $50 of ETI from the LLC. The blocker’s 30% of ATI limitation is $45 ($150 x 30%). The blocker can fully deduct $25 of BIE which includes its own $20 BIE plus $5 of prior year excess business interest expense from the LLC.

9. Can the blocker offset and deduct excess business interest expense from one LLC against excess taxable income or excess business interest income from another LLC?

The I.R.C. section 163(j) regulations allow the blocker corporation to offset and deduct excess business interest expense from one LLC against excess taxable income or excess business interest income from another LLC.

10. What is the tax treatment of disallowed corporate level interest?

If the blocker is not allowed to be an electing real property trade or business and incurs interest expense annually on loans from a foreign parent or third party, the interest expense would be carried forward indefinitely. If the deal is sold at a significant gain, the blocker may be able to deduct its corporate level interest under the 30% ATI limitation rule. If the corporate level interest expense exceeds 30% of the corporation’s flow through income from the LLC, it appears that the excess is disallowed and carried forward. If it is the last year of the blocker because the property was sold and the blocker will not invest in a future property, it appears the excess interest will be disallowed and never utilized. It does not receive the same treatment as excess interest for an LLC which is added to basis.

Conclusion

Tax advisors to inbound investors in U.S. real estate will need to address a myriad of unanswered questions in complying with the new tax provisions from the Tax Cuts and Jobs Act. This article only touched on some issues relating to deductibility of interest and ADS depreciation.

Are you ready to gain control over your Business interests?

Contact us today to see how Wagner Duys & Wood can help you succeed.